Unfurnished Property for Sale in Maitama 2, Maitama District, Abuja

Quick Filters

Types Areas Furnishing

20

3 bedroom block of flats for sale

Maitama Extension, Mpape, Maitama 2, Maitama District, Abuja ₦110,000,0004 bedroom terraced duplex for sale

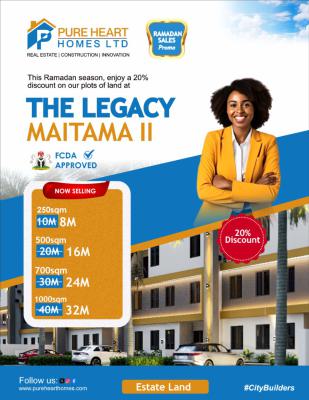

Maitama Extension, Mpape, Maitama 2, Maitama District, Abuja ₦190,000,000Residential land for sale

Estora Residence, Maitama 2, Maitama District, Abuja ₦5,500,000 per square meterHow many furnished flats, houses, land and commercial property for sale in Maitama 2, Maitama District, Abuja are available?

There are 110 available furnished flats, houses, land and commercial property for sale in Maitama 2, Maitama District, Abuja.

You can view and filter the list of property by price, furnishing and recency.