Joint Venture Land in Lekki, Lagos

Quick Filters

Subtypes Localities Areas

- Abijo|

- Agungi|

- Idado|

- Igbo Efon|

- Ikate|

- Ikate Elegushi|

- Ikota|

- Ilasan|

- Jakande|

- Lafiaji|

- Lekki Expressway|

- Lekki Free Trade Zone|

- Lekki Phase 1|

- Lekki Phase 2|

- Nicon Town|

- Ologolo|

- Orange Island|

- Osapa|

- VGC

- 1st Roundabout|

- 2nd Roundabout|

- 2nd Toll Gate|

- Admiralty Homes Estate|

- Admiralty Road|

- Ajiran Road|

- Alma Beach Estate|

- Alperton Estate|

- Alpha Beach|

- Alpha Beach Estate|

- Alpha Beach Road|

- Arcadia Grove Estate|

- Atlantic Estate|

- Atlantic View Estate|

- Bakare Estate|

- Bayview Estate|

- Bera Estate|

- Bourdillon Court|

- Bridge Gate Estate|

- Brookhill Park Estate|

- Brownstone Estate|

- Buena Vista Estate|

- Cadogan Estate|

- Cadogan Place Estate|

- Canal West Estate|

- Cardogan Estate|

- Carlton Gate Estate|

- Chevron Alternative Route|

- Chevron Drive|

- Chevron Toll Gate|

- Chevy View Estate|

- Chois Gardens Estate|

- Cooplag Gardens Estate|

- Cowrie Creek Estate|

- Cromwell Court Estate|

- Cyberville Estate|

- Eastland Golf Estate|

- Eleganza Estate|

- Elf Estate|

- Estates|

- Estates|

- Estates|

- Estates|

- Fara Park Estate|

- Femi Okunnu Estate|

- Flourish Gate Garden|

- Freedom Way|

- Friends Colony Estate|

- Frisco Court|

- Goshen Estate|

- GRA|

- Green Park Estate|

- Hampton Bay Estate|

- Heirs Park Estate|

- Horizon II Estate|

- House on the Rock|

- HRC Estate|

- Idado Estate|

- Ikota County Estate|

- Ikota Villa Estate|

- Inoyo Havens Estate|

- Itedo Estate|

- Ivy Luxuria Estate|

- Jakande First Gate|

- Jordan Brooke Estates|

- Kusenla Road|

- Lakeview Estate|

- Lekki Conservation Centre|

- Lekki County Estate|

- Lekki Gardens Horizon 1|

- Lekki Pearl Garden|

- Lekki Scheme 2|

- Lekki Scheme I|

- LSDPC Estate|

- Maiyegun Beach Estate|

- Manor Gardens Estate|

- Marwa|

- Megamound Estate|

- Melrose Park Estate|

- Milverton Estate|

- Mobil Estate|

- Mobolaji Johnson Estate|

- Napier Gardens Estate|

- New Horizon Estate|

- New Road|

- Nicon Town|

- Northern Foreshore Estate|

- Oba Oyekan Estate|

- Ocean Bay Estate|

- Ocean Breeze Estate|

- Oluwanishola Estate|

- Oral Estate|

- Orchid Estate|

- Orchid Road|

- Paradise Estate|

- Parkview Estate|

- Peach Palms|

- Pearly Gate Estate|

- Periwinkle Lifestyle Estate|

- Pinnock Beach Estate|

- Prime Water View Estate|

- Providence Street|

- Richmond Gate Estate|

- Romay Gardens Estate|

- Royal County Estate|

- Royal Haven Estate|

- Royal Pine Estate|

- Safe Court Apartments|

- Seagate Estate|

- Silicon Valley Estate|

- Southern View Estate|

- South Pointe Estate|

- SPG Road|

- Spring Bay Estate|

- Spring Garden Estate|

- Stillwaters Garden Estate|

- The Grandeur Estate|

- TPDC Estate|

- Treasure Garden Estate|

- Tulip Heaven Estate|

- Twin Lake Estate|

- U3 Estate|

- UPDC Estate|

- Valley Stream Estate|

- Van Daniel Estate|

- Victoria Bay Estate|

- Victoria Crest Estate|

- Victoria Park Estate|

- Victory Park Estate|

- Vintage Park Estate|

- Westend Estate|

- Western Foreshore Estate|

- White Oak Estate|

- Willow Greens Estate|

- Woodland Estate|

- Zion Court Estate

20

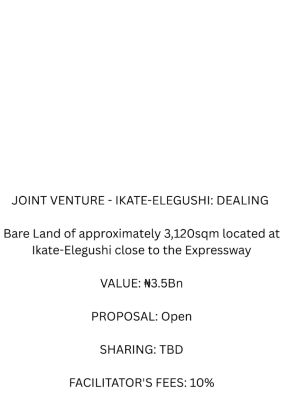

Mixed-use land joint venture

Ikate Close To House On The Rock Church, Ikate, Lekki, Lagos ₦3,500,000,000How many land joint venture in Lekki, Lagos are available?

There are 177 available land joint venture in Lekki, Lagos.

You can view and filter the list of property by price, furnishing and recency.