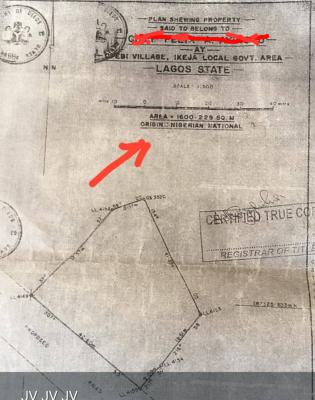

Joint Venture Land in Ikeja, Lagos

Quick Filters

Subtypes Localities Areas

- Adeniyi Jones|

- Agidingbi|

- Alausa|

- Allen|

- Iju|

- Ikeja GRA|

- Mangoro|

- Oba Akran|

- Ogba|

- Omole Phase 1|

- Omole Phase 2|

- Onigbonbo|

- Opebi|

- Oregun

- ABC Estate|

- Adekoya Estate|

- Adeyeri Estate|

- Agbalajobi Estate|

- Ajayi Road|

- Akora Estate|

- Alafia Estate|

- Alfred Garden Estate|

- Allen Avenue|

- Allen Avenue|

- Anthony Enahoro Estate|

- Awuse Estate|

- Bamako Estate|

- Berry Court|

- Cement Estate|

- College Road|

- Computer Village|

- Dideolu Estate|

- Emeka Anyaoku Estate|

- Estates|

- Estates|

- Harmony Estate|

- Ikeja City Mall|

- Ikeja GRA|

- Isaac John Street|

- Juli Estate|

- Justice Coker Estate|

- K Farm Estate|

- Kudirat Abiola Way|

- LSDPC Estate|

- Minimah Estate|

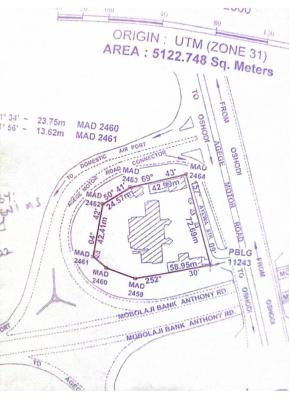

- Mobolaji Bank Anthony Way|

- Oluwole Estate|

- Opebi Road|

- Peace Estate|

- Punch Estate|

- Toyin Street|

- Wemabod Estate

20

How many land joint venture in Ikeja, Lagos are available?

There are 34 available land joint venture in Ikeja, Lagos.

You can view and filter the list of property by price, furnishing and recency.