Flats for Sale in Victoria Island (VI), Lagos

Quick Filters

Bedrooms Subtypes Areas Areas Sub Areas

- 1004 Estate|

- Adeola Odeku Street|

- Adetokunbo Ademola Street|

- Ahmadu Bello Way|

- Ajose Adeogun Street|

- Akin Adesola Street|

- Bishop Oluwole Street|

- Covenant Estate|

- Dideolu Estate|

- Eko Hotel|

- Estates|

- Kofo Abayomi Street|

- Landmark Beach|

- Millennium Estate|

- Oniru Estate|

- Oyin Jolayemi Street|

- Ozumba Mbadiwe Road|

- Palace Road|

- Saka Tinubu Street

21

approx. ₦606,082,720

approx. ₦4,431,265,169

approx. ₦357,360,094

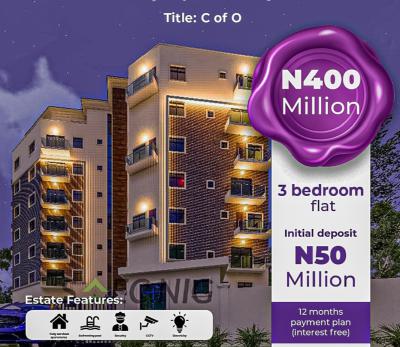

3 bedroom flat / apartment for sale

Ozumba Mbadiwe, Victoria Island (VI), Lagos $424,000approx. ₦606,082,720

4 bedroom flat / apartment for sale

Off Adeola Odeku, Victoria Island (VI), Lagos $3,100,000approx. ₦4,431,265,169

2 bedroom flat / apartment for sale

Off Akin Adeshola Street, Victoria Island (VI), Lagos ₦450,000,0003 bedroom flat / apartment for sale

Waterside Road, Oniru, Victoria Island (VI), Lagos $250,000approx. ₦357,360,094

What is the average price of flats for sale in Victoria Island (VI), Lagos?

The average price of flats for sale in Victoria Island (VI), Lagos is ₦400,000,000.

What is the price of the most expensive flats for sale in Victoria Island (VI), Lagos?

The price of the most expensive flats for sale in Victoria Island (VI), Lagos is ₦4,000,000,000.

What is the price of the cheapest flats for sale in Victoria Island (VI), Lagos?

The price of the cheapest flats for sale in Victoria Island (VI), Lagos is ₦20,000,000.

How many flats for sale in Victoria Island (VI), Lagos are available?

There are 1,158 available flats for sale in Victoria Island (VI), Lagos.

You can view and filter the list of property by price, furnishing and recency.